A diversified portfolio unified

We’ve built our portfolio with a commitment to our long-term, fundamental approach to investing in private businesses and real estate with those who share our core values.

Our flagship businesses

Flagship businesses are companies in which PSP has a significant ownership stake and is partnering with management to support long-term growth and strategic priorities.

Artemis Real Estate Partners is an investment manager based in metropolitan Washington, DC, with offices in New York City, Los Angeles, and Atlanta. Artemis has raised $9 billion of capital across core, core plus, value-add, and opportunistic strategies. The firm makes equity and debt investments in real estate across the United States, with a focus on multifamily, industrial, office, retail, hospitality, senior housing, and medical office. Artemis specializes in joint venture partnerships and direct investments.

DEPT is a pioneering technology and marketing services company that creates end-to-end digital experiences for brands such as Google, KFC, Philips, Audi, Twitch, Patagonia, eBay, and more. Its team of 3,500+ digital specialists across 30+ locations on 5 continents delivers pioneering work on a global scale with a boutique culture.

For over 90 years, E.B. Bradley Co. has been more than a supplier to America’s designers and fabricators. From its start in 1929 as a hardware distributor in Los Angeles, E.B. Bradley Co. has grown to become the West Coast’s largest surfacing product and specialty hardware. See success story here

With unmatched technology and category-defining innovation, Icertis pushes the boundaries of what’s possible with contract lifecycle management (CLM). The AI-powered, analyst-validated Icertis Contract Intelligence (ICI) platform turns contracts from static documents into strategic advantage by structuring and connecting the critical contract information that defines how an organization runs. Today, the world’s most iconic brands and disruptive innovators trust Icertis to fully realize the intent of their combined 10 million+ contracts worth more than $1 trillion, in 40+ languages, and 90+ countries.

Ntiva is a leading IT services company that provides businesses across the U.S. with advanced technology expertise and support, including managed IT services, strategic consulting, cybersecurity services, cloud services, and digital transformation services. Its team of world-class talent genuinely cares about the relationships they build and understands that response and precision are fundamental keys to a successful partnership. Ntiva's ultimate objective is to help clients leverage their technology investments to improve business performance. See success story here

Pritzker Realty Group (PRG) makes and manages direct investments in real estate assets, portfolios, operating companies, and joint ventures with an emphasis on multifamily housing and industrial property in the United States.

StormTrap offers proven and leading-edge solutions for managing runoff, protecting waterways and improving use of property. StormTrap provides cost-effective, customized water management solutions to engineers, owners, and municipalities across North America and abroad. See success story here

Our strategic investments

Strategic investments, mostly non-control, are situations where PSP works closely with management and other investors to

support growth.

Acrisure is a global fintech leader and insurance company headquartered in Grand Rapids, Michigan. The company provides customers with intelligence-driven financial services solutions for insurance, reinsurance, real estate services, cyber services, and asset and wealth management.

Adept is building a B2B machine learning model that interacts with everything on your computer, automating tasks across multiple applications for ease of use.

Albertsons Companies is one of the largest food and drug retailers in the United States, with over 2,200 stores in 34 states and the District of Columbia. Their well-known banners include Albertsons, Safeway, Vons, Jewel-Osco, Shaw's, Acme, Tom Thumb, Randalls, United Supermarkets, Pavilions, Star Market, Haggen, Carrs, Kings Food Markets, and Balducci's Food Lovers Market. Albertsons supports its stores with 22 distribution centers and 19 manufacturing plants.

Arboretum Partners is a North Carolina-based long-term oriented real estate investment management and development firm focused on partnering with like-minded stakeholders to achieve compelling risk-adjusted outcomes, while improving the built environment and enriching the community.

Beachfront is the sell-side ad server built for convergent TV. Its technology enables real-time, unified ad serving and monetization across all TV and video endpoints, including connected TV (CTV), set-top box VOD, spot linear, and national addressable television. Leading media owners, programmers, and distributors utilize Beachfront’s TV-first tech stack to drive advertising revenue, improve ad operations, and deliver premium ad experiences to their viewers.

Benchmark Analytics is a revolutionary police force management platform designed to measure and advance officer and department performance across the U.S.

Since 1998, Blue Dog Bakery has been making all-natural and healthy treats for dogs. The company started on a small houseboat in Seattle, WA with a simple mission of providing high quality treats to dogs nationwide. Today, Blue Dog has grown to become a leader in better-for-you dog treats. Blue Dog Bakery is a high-quality, premium brand widely available in over 40,000 stores across North America. Its treats are made in the USA with only wholesome, non-GMO human-grade ingredients and never contain any artificial ingredients or animal by-products.

Ellevest is an investment platform and financial literacy program built for women, by women. The company was founded by Sallie Krawcheck in 2014 with the mission to get more money in the hands of women by building a financial services company.

Enable is a cloud-based software platform that drives enhanced efficiency, compliance, and financial transparency for B2B rebate and other commercial programs for robust supply chain and channel partner ecosystems.

From startups to publicly traded companies, Finix offers everything software platforms need to build world-class payments experiences.

Fresh Edge is one of the largest independent fresh food distributors in the United States and a category leader in providing both the foodservice and retail industries with fruit, vegetables, proteins, fresh grab-n-go offerings, dairy, floral, and specialty products.

Guidewheel is on a mission to empower all the world’s factories to reach sustainable peak performance with their plug-and-play FactoryOps platform that makes the power of the cloud accessible to any factory. Guidewheel clips onto any machine to turn its real-time “heartbeat” into a connected, actively learning system that empowers teams to reduce lost production time, increase throughput, and perform better and better over time.

Founded in 2018, Higharc is a generative design construction platform supporting the homebuilding process that streamlines and automates workflows, construction documents, purchasing estimates and 3D sales tools.

Founded in 2013, valuation-focused real estate brokerage HouseCanary provides software and services to reshape the real estate marketplace. Financial institutions, investors, lenders, mortgage investors, and consumers turn to HouseCanary for industry-leading valuations, forecasts, and transaction-support tools. These clients trust HouseCanary to fuel acquisition, underwriting, portfolio management, and more.

Hyatt Hotels Corporation, headquartered in Chicago, is a leading global hospitality company guided by its purpose – to care for people so they can be their best. As of March 31, 2023, the Company’s portfolio included more than 1,250 hotels and all-inclusive properties in 75 countries across six continents.

ID.me simplifies how individuals prove and share their identity online. The company provides identity proofing, authentication, and group affiliation verification for organizations across sectors.

Kaya is an advisory firm that provides global climate policy advice to investors and corporate leaders. The Kaya advisory team holds decades of experience advising CEOs, governments, and strategic decision makers across industries and geographies.

Ocient delivers hyperscale data solutions for modern enterprises that derive value from analyzing trillions of data records in interactive time. Ocient’s team of industry veterans has built enterprise database solutions for the world’s largest companies with the world’s largest and most complex datasets.

OpenSpace provides next-generation reality capture software, image-led collaboration tools, and powerful analytics for the construction and built world industries.

Piazza is a leading collaborative learning platform, facilitating learning, development, and engagement among university students and professors beyond the traditional classroom. Piazza’s products offerings include its core learning platform as well as career opportunity enablement.

Pronto Housing provides software that accelerates the affordable housing leasing and compliance process through tech-enabled solutions, an expert compliance team, and a customer centric approach.

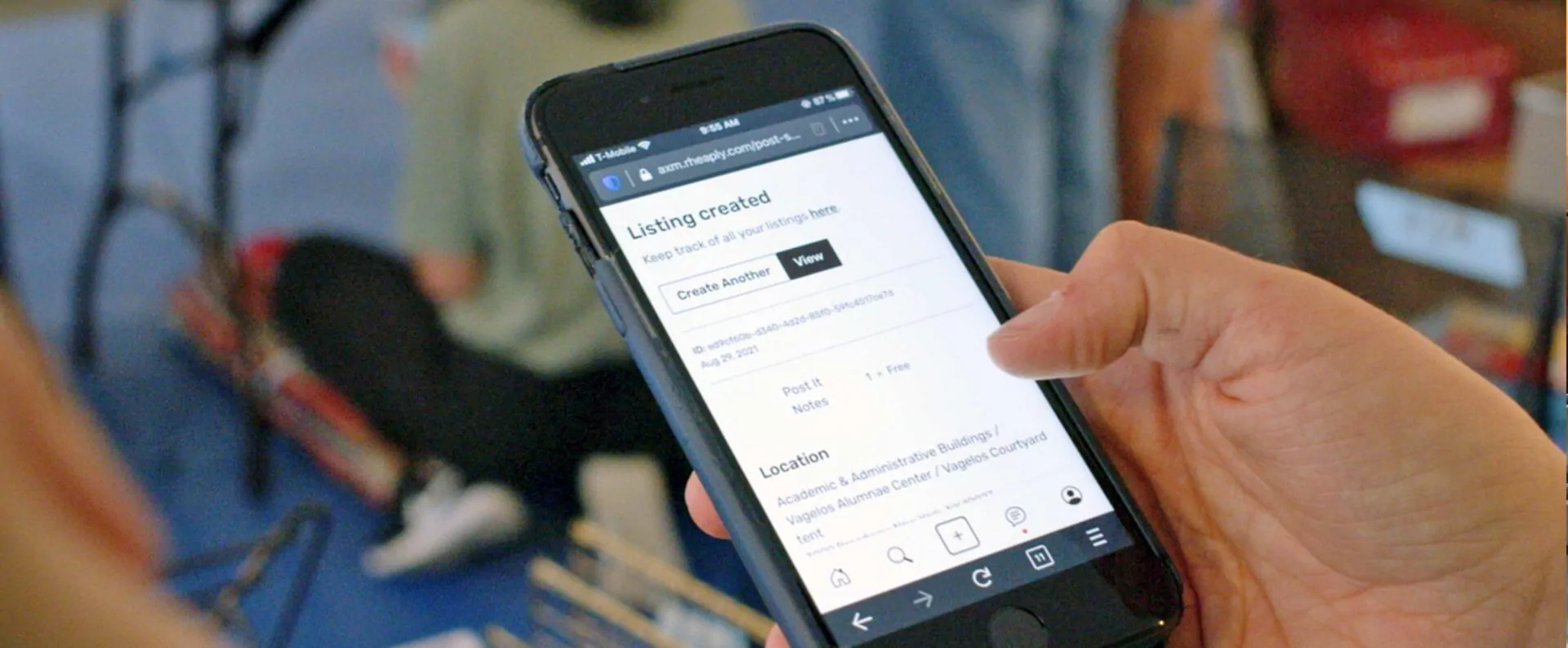

The Rheaply Platform is a cloud-based resource exchange technology application for connecting people and organizations with resources to those who need them, improving reuse outcomes and catalyzing the circular economy. As the only market solution that combines an asset management system with an online marketplace, Rheaply’s platform enables organizations to exchange materials and resources more effectively, eliminating unnecessary waste and spend.

Vi Senior Living is a high-end Life Plan community developer, owner and management group based out of Chicago, Illinois, United States. Vi operates 10 Life Plan Communities across the United States where residents enjoy stylish apartments, world-class cuisine, varied lifestyle programming, and deep friendships.

Vistage is the world’s largest executive coaching organization for small and midsize businesses. For more than 65 years the company has helped CEOs, business owners, and key executives solve their toughest challenges through a comprehensive approach to success. At the heart of its proven formula is confidential peer advisory groups and executive coaching programs.

VTS is a leading commercial real estate technology platform that transforms how strategic decisions are made and executed across the asset lifecycle. The VTS Platform is the largest first-party data source in the industry and delivers data insights and solutions to fuel investment and asset strategy, leasing and marketing automation, property operations, and tenant experience.

Businesses we have founded or co-founded

The following are a listing of businesses founded or co-founded by Penny Pritzker.

Artemis Real Estate Partners is an investment manager based in metropolitan Washington, DC, with offices in New York City, Los Angeles, and Atlanta. Artemis has raised $9 billion of capital across core, core plus, value-add, and opportunistic strategies. The firm makes equity and debt investments in real estate across the United States, with a focus on multifamily, industrial, office, retail, hospitality, senior housing, and medical office. Artemis specializes in joint venture partnerships and direct investments.

Inspired Capital is an early-stage venture capital firm based in New York City, investing in the entrepreneurs of tomorrow. The firm was founded by Alexa von Tobel, who previously founded LearnVest, and Penny Pritzker. With $500M under management, the firm invests in tech-advantaged, capital efficient businesses. By leveraging deep experience across consumer and enterprise technology, Inspired Capital strives to help businesses at the Seed and Series A stages become category-defining companies.

Founded in 1998, The Parking Spot is the leading near-airport parking company in the United States with 38 locations at 22 airports.

Pritzker Realty Group (PRG) makes and manages direct investments in real estate assets, portfolios, operating companies, and joint ventures with an emphasis on multifamily housing and industrial property in the United States.

Vi Senior Living is a high-end Life Plan community developer, owner and management group based out of Chicago, Illinois, United States. Vi operates 10 Life Plan Communities across the United States where residents enjoy stylish apartments, world-class cuisine, varied lifestyle programming, and deep friendships.

Our exited investments

The following are a listing of our past investments and businesses.

Founded in 1998, The Parking Spot is the leading near-airport parking company in the United States with 38 locations at 22 airports.